A new car brings great joy – but when you look at financing, reality often hits. In Switzerland, car leasing has been popular for years, as it allows you to drive a car without paying the high upfront cost of a purchase.

However, behind the initially low monthly leasing rates often lie hidden fees, residual value risks, and additional costs. The actual savings are therefore often smaller than expected.

In this article, we show you how to accurately assess leasing rates, spot hidden costs, and why a car subscription can be a stress-free alternative to traditional leasing.

Car Leasing: The Illusion of Low Monthly Rates

When considering a car lease, you probably first look at the monthly rate. At first glance, these often seem appealingly low – but they cover only part of the real costs: the car’s depreciation over the term and the interest.

Components of a Leasing Rate

If you want to calculate your lease correctly and know what your dream car really costs, you should examine the monthly rate carefully. It consists of several important components:

Car purchase price:

This is the actual price the leasing company (or bank) pays for the car. It depends on the model, trim, and extras. Additional features such as assistance systems or a more powerful engine quickly raise the price.

Residual value:

The estimated value of the car at the end of the lease term. The higher the residual value in the contract, the lower the expected depreciation – and thus the monthly rate.

If you plan to buy the car after the lease: The residual value can be set lower so that you pay less later. Ensure you have a pre-purchase option, otherwise the dealer could resell the car at a higher market price.

If you do not plan to buy: A higher residual value benefits you, as it lowers the monthly rate.

Lease term and mileage package:

The term is usually set between 24 and 48 months. You also define the annual mileage (typically 10,000–20,000 km), which often cannot be changed after signing.

Interest rate (leasing interest):

This is the financial charge for the borrowed capital. It varies widely depending on the provider – comparison is essential. Be careful with 0% leasing offers, as these often include hidden costs or fees.

Down payment / initial payment:

A one-time upfront payment deducted from the financing amount. This reduces monthly rates but does not change total costs – you just pay a portion immediately instead of over the lease term.

It is also possible to lease without a down payment. All key information is here available when considering this option.

The Formula Behind a Leasing Rate

Essentially, the monthly rate is calculated as the difference between purchase price and residual value (adjusted for agreed mileage: more km → lower residual, fewer km → higher residual), divided over the lease term, plus interest.

The Pitfalls of Online Leasing Calculators

Even if you calculate your lease with an online tool, it often shows only part of the truth. Most calculators consider only the financing costs – extras like insurance, service, or taxes are not included. These costs can quickly erase any apparent savings, making leasing more expensive and less predictable than expected.

Hidden Costs of Car Leasing

To realistically estimate the total cost of your lease, you cannot look at monthly rates alone. You must include essential additional cost blocks such as insurance, service, or taxes.

The media spokesperson of the Touring Club Switzerland (TCS) puts it plainly: “To get the effective monthly cost, you have to multiply the leasing rate by three.” What seems exaggerated at first glance is often realistic on closer inspection.

1. Insurance: Mandatory comprehensive cover

For car leasing in Switzerland, comprehensive insurance is mandatory since the car belongs to the leasing company, not you.

Cost factor: Premiums vary greatly depending on age, location, and car model. These costs are not included in the lease and must be paid separately, often forming a significant part of monthly expenses.

2. Service and maintenance

Regular servicing is essential for value retention and safety. The leasing company requires that all service intervals are followed.

Cost factor: These costs are irregular and sometimes unexpected. Expect several hundred to over a thousand CHF per year, depending on the car model and age.

3. Tyres and wheel changes

Winter and summer tyres, storage, and seasonal swaps are your responsibility during the lease.

Cost factor: Purchasing new tyres every few years, seasonal changes, storage, and possible repairs add up quickly.

4. Taxes and fees

You must also cover statutory costs such as motor vehicle tax and road fees. Additional charges may apply for cantonal registration and administrative processing.

Cost factor: Varies by canton and car model (performance, weight, CO₂ emissions) and must be budgeted separately.

5. Major risk factors: Excess wear, excess mileage, other fees, and early termination

Excessive wear:

At the end of the lease term, you may face costs for excessive wear if the car is not returned according to agreed standards, e.g., scratches, dents, or damaged interiors.

Excess mileage:

Mileage is often fixed. If you exceed it, you may have to pay a substantial fee per extra kilometre. Calculating your lease without this buffer is incomplete.

Other fees:

If the lease contract terms are not followed, additional fees may apply, e.g., for missing documents or missed inspections.

Early termination:

Ending the lease early can be very expensive. You may owe a prepayment penalty, and monthly rates may be recalculated over a shorter term, increasing the total cost.

Transferring the lease to a third party can sometimes help, though it is often cumbersome.

Tip: Carefully review contract terms and plan lease duration and mileage to avoid high additional costs.

Example Calculation: True Monthly Cost

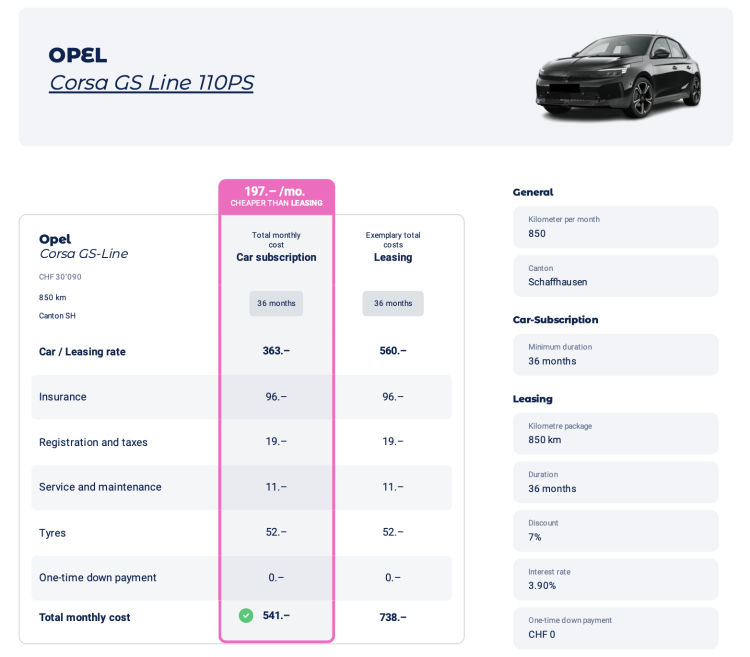

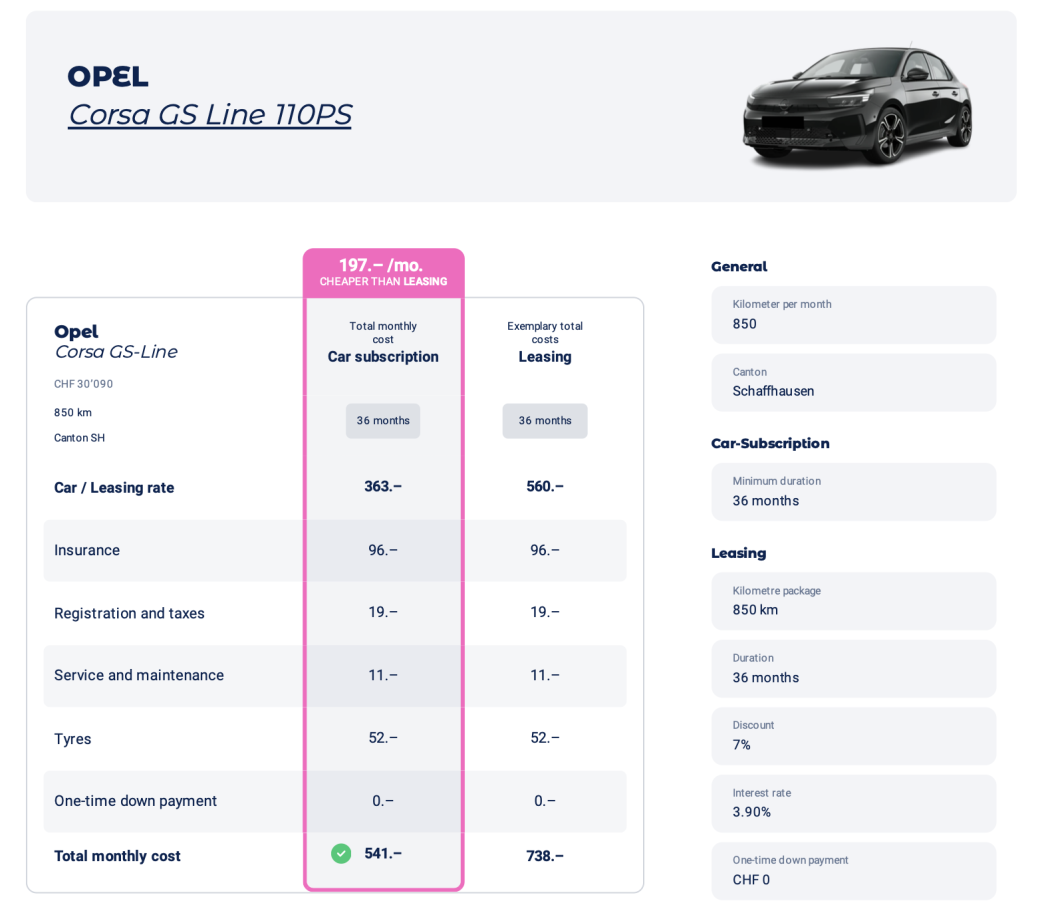

To better illustrate total leasing costs, consider this practical example (calculated in December 2025, may not be current; check our cost comparison for up-to-date numbers):

You are interested in an Opel Corsa GS-Line. The list price is CHF 30,090. You want to lease it for 3 years, drive about 10,000 km per year, and live in Schaffhausen. The dealership offers a 7% discount. The lease proposal: 0 CHF down payment, 3.9% interest, monthly rate CHF 560. Looks tempting, right?

However, including insurance, registration and taxes, service, maintenance, tyres, the effective monthly cost is CHF 738.

With a Carvolution car subscription, it is simpler, more transparent, and cheaper: the same Opel Corsa GS-Line would cost only CHF 541/month, all-inclusive.

The Carvolution Car Subscription: Transparent Alternative to Leasing

The all-inclusive car subscription from Carvolution includes a wide vehicle selection and covers insurance, registration, taxes, service, maintenance, and tyres – all in a single price. Thanks to large order volumes and lean organisation, Carvolution offers more competitive conditions, which you directly benefit from.

You can also flexibly adjust your mileage monthly, so you avoid the risk of extra charges for over-mileage or underused cars.

Carvolution also guarantees the best price compared to the total cost of a comparable lease. If our costs turn out higher, we lower your subscription price.

If you are interested in a car subscription but unsure if it is right for you, our experts are happy to provide non-binding advice and help you compare a car subscription with leasing costs using your individual lease and insurance offer.

Sale

Benefit from attractive discounts on selected vehicles. Everything is included in the subscription, and a buyout is possible at the end!