Many people underestimate how much money goes into their car each month – often by half! This blog shows you how to realistically assess your actual car costs using a simple 3-step “back-of-the-envelope” calculation. Discover where hidden costs lie – and how a car subscription might even save you money.

A car is one of the largest household expenses for many of us. Yet despite the high costs, most people have little idea of what they actually spend each month. That’s why it’s so important to know your own car costs – because that’s the only way to uncover real saving potential!

A study shows: Most drivers in Switzerland underestimate their monthly car costs by around 50%! Those who think their car costs CHF 300 are often paying over CHF 600 a month in reality. This widespread cost underestimation is a common issue.

Why does this happen? Simple: Many costs occur irregularly (like maintenance and insurance). And one of the biggest factors – vehicle depreciation – is often completely overlooked. Since depreciation doesn’t arrive as a monthly bill, but rather as money lost when selling the car, it often goes unnoticed.

With our easy 3-step “back-of-the-envelope” method, you can get a realistic idea of what your car really costs – and the result might surprise you.

Your Car Costs Made Simple: The 3-Step Rule of Thumb

Forget complex spreadsheets. With this simple rule of thumb, you can easily estimate your monthly car expenses.

Step 1: Calculate Depreciation – the Biggest Cost!

The largest and most underestimated cost is depreciation. A new car loses most of its value in the first three years – often more than 50% of the original price!

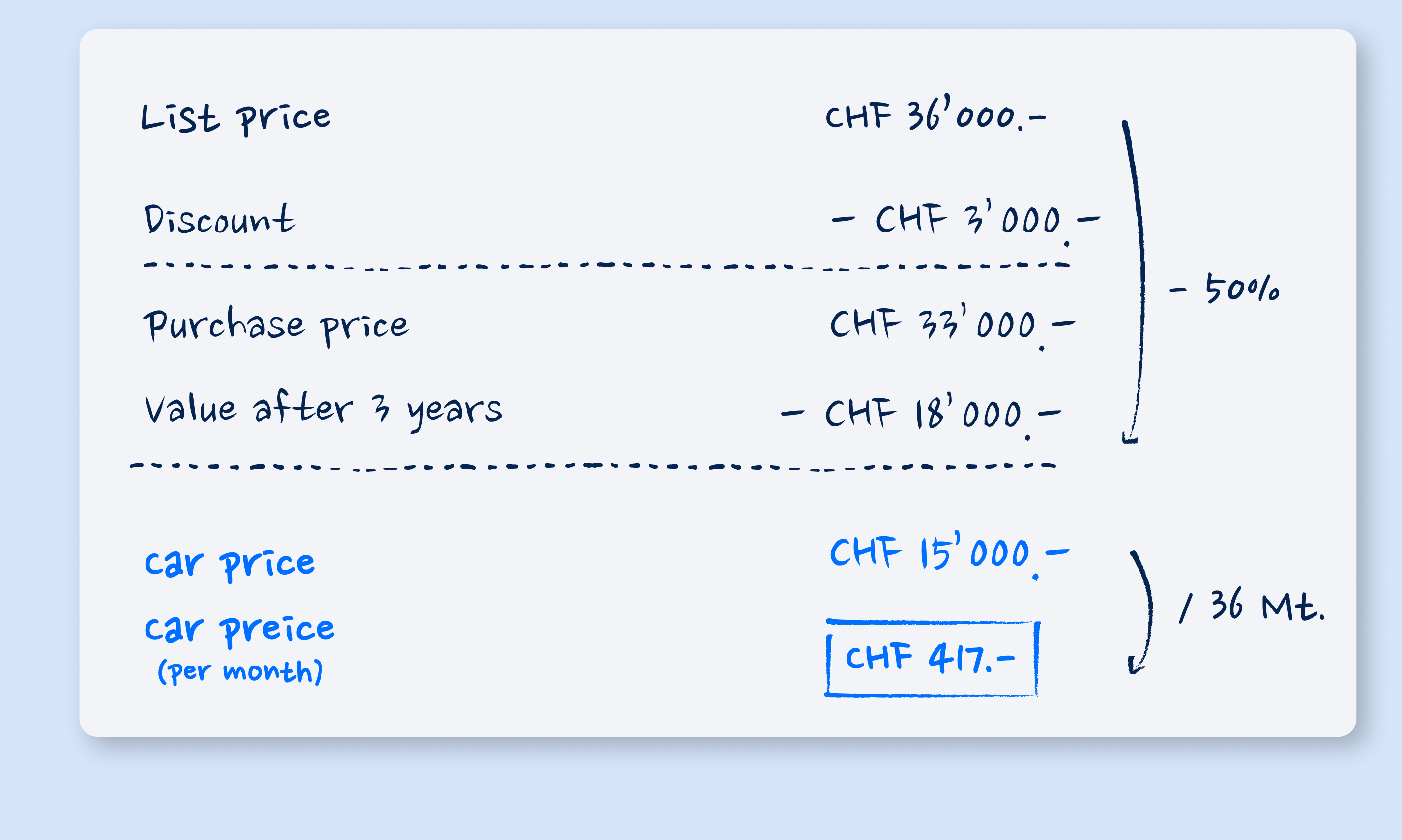

Rule of thumb: Take the purchase price of your car (or the estimated price after discounts).

To calculate monthly depreciation:

Estimate how much your car will be worth after 3 years.

Subtract that from the purchase price – this is your depreciation.

Divide that by 36 months to find the monthly cost.

Example “back-of-the-envelope” calculation

Step 2: Add Running Costs – the Forgotten Expenses

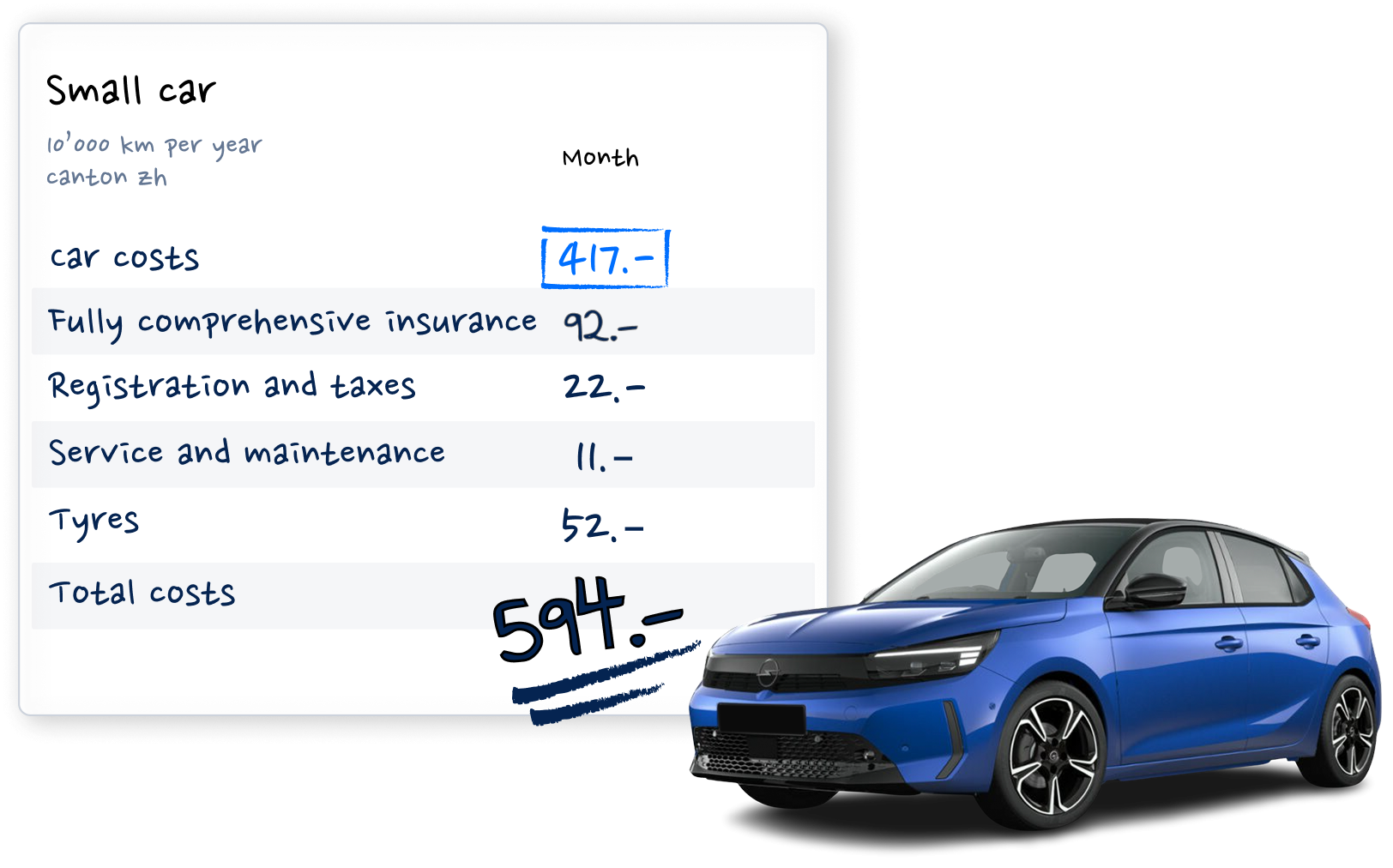

Aside from depreciation, there are many ongoing costs that people often forget but that make up a large part of monthly spending:

Insurance: Fully comprehensive is standard for new cars. Estimate CHF 80–150.- per month.

Servicing & Maintenance: Regular inspections and repairs. Plan CHF 10–100.- per month.Tyres: Summer/winter tyres, fitting, storage. Estimate CHF 30–60.- per month.

Taxes & Registration: Annual road tax and registration fees. Estimate CHF 20–40.- per month.

Individual costs: Parking, fuel or charging (variable)

Example “back-of-the-envelope” calculation

Step 3: Compare – Find the Savings Potential

Now that you have a realistic overview of a purchased small car’s costs – how does it compare to a Carvolution car subscription?

Purchased car (monthly): CHF 594.–

Carvolution subscription (monthly): CHF 541.–

The result is clear: With a car subscription, you not only save money but also avoid hassle. All the above-mentioned costs (insurance, service, tyres, tax, registration) are included! You pay a fixed monthly price and don’t have to worry about anything – except fuelling or charging.

Next Steps: Calculate It Yourself or Get Expert Advice

Would you like to calculate your personal car costs in detail? Or see right away how much you could save with Carvolution?

Go to our car cost calculator

View our car subscription offers

Conclusion: Stop underestimating your car costs! This 3-step “back-of-the-envelope” method is a simple way to gain clarity – and potentially save a lot of money. With a car subscription, you benefit from full cost control and maximum flexibility – without any hidden costs.

Sale

Benefit from attractive discounts on selected vehicles. Everything is included in the subscription, and a buyout is possible at the end!