You probably know that cars are one of the biggest household expenses in Switzerland. Nevertheless, the costs are regularly massively underestimated. This has to do with the fact that the costs are spread over the year and that the depreciation or the loss in value of the vehicle is often not taken into account enough. Read the blog and find out how to keep an eye on total costs of your car.

If you want to buy a new car, you should consider the total costs beforehand. This can be done when buying a car, leasing a car or subscribing to Carvolution. Data from TCS for the operating costs that will be incurred later is helpful, it’s such also the indicative values from Allianz for the depreciation of the car. How such a calculation can look is explained in detail below.

In the table below, you can see the costs for buying or leasing listed on the left-hand side, while the Carvolution car subscription is listed on the right-hand one. The monthly fixed price already includes everything related to the car.

Example calculation

Example calculation for a small car. Costs per month for a holding period of 3 years.

In the concrete example of a small car, it can be determined that the following costs are incurred for holding periods of one, three and eight years:

- Holding period one year: 581 CHF per month

- Holding period three years: 532 CHF per month

- Holding period 8 years: 381 CHF per month

There are those costs that are relatively easy to determine. These include the garage and the fuel or charging costs. There are also smaller costs such as incidental expenses or vehicle maintenance costs. The biggest cost drivers for a car are the following:

- Depreciation and loss of value

- Insurance (comprehensive and third-party liability insurance)

- Service and repairs

- Tyre costs (purchase, storage and change)

- Taxes

- Financing costs

Depreciation and loss of value

The depreciation or loss in value of the car differs depending on the make and model. It is also influenced by the market and demand. If you want to know exactly how much, Allianz gives good guidelines for a simple calculation of the future selling price of the car:

- A car loses about a quarter of its list price in the first year. This is the price that the manufacturer recommends for a vehicle without obligation. A three-year-old car is worth about 50 percent less of its list price when it is sold.

So you see, the depreciation of a car is enormous in the first few years. Taking a small car as an example, the costs for depreciation and loss of value are as follows:

the vehicle price corresponds to CHF 24,100. In addition, 3'848 CHF are added for special equipment.

- Residual value after 1 year: 20'961 CHF

- Residual value after 3 years: 13'974 CHF

Assuming a realistic purchase discount of around 10%, the monthly cost of the depreciation is 349 CHF per month for one year and 311 CHF per month for three years.

You should know that the discount has no influence on the residual value, because this is determined by the market or the value of the car. Therefore, the residual value is calculated on the basis of the list price, i.e. the vehicle price plus the optional equipment. And the depreciation is the difference between the purchase price and the residual value.

Operating costs

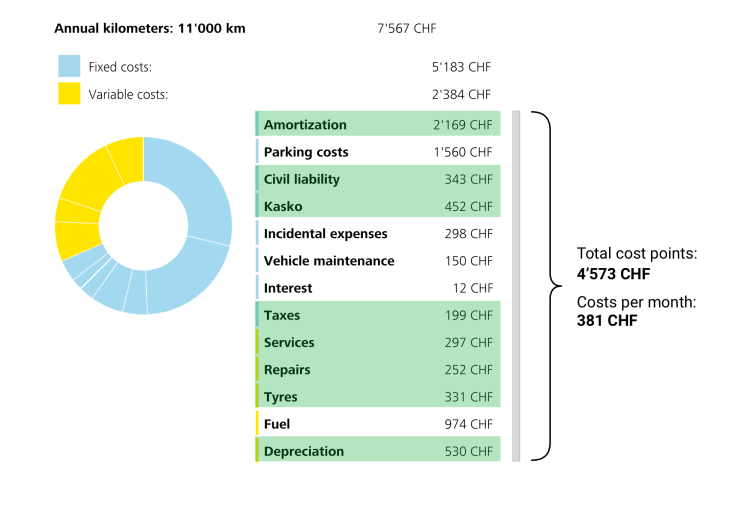

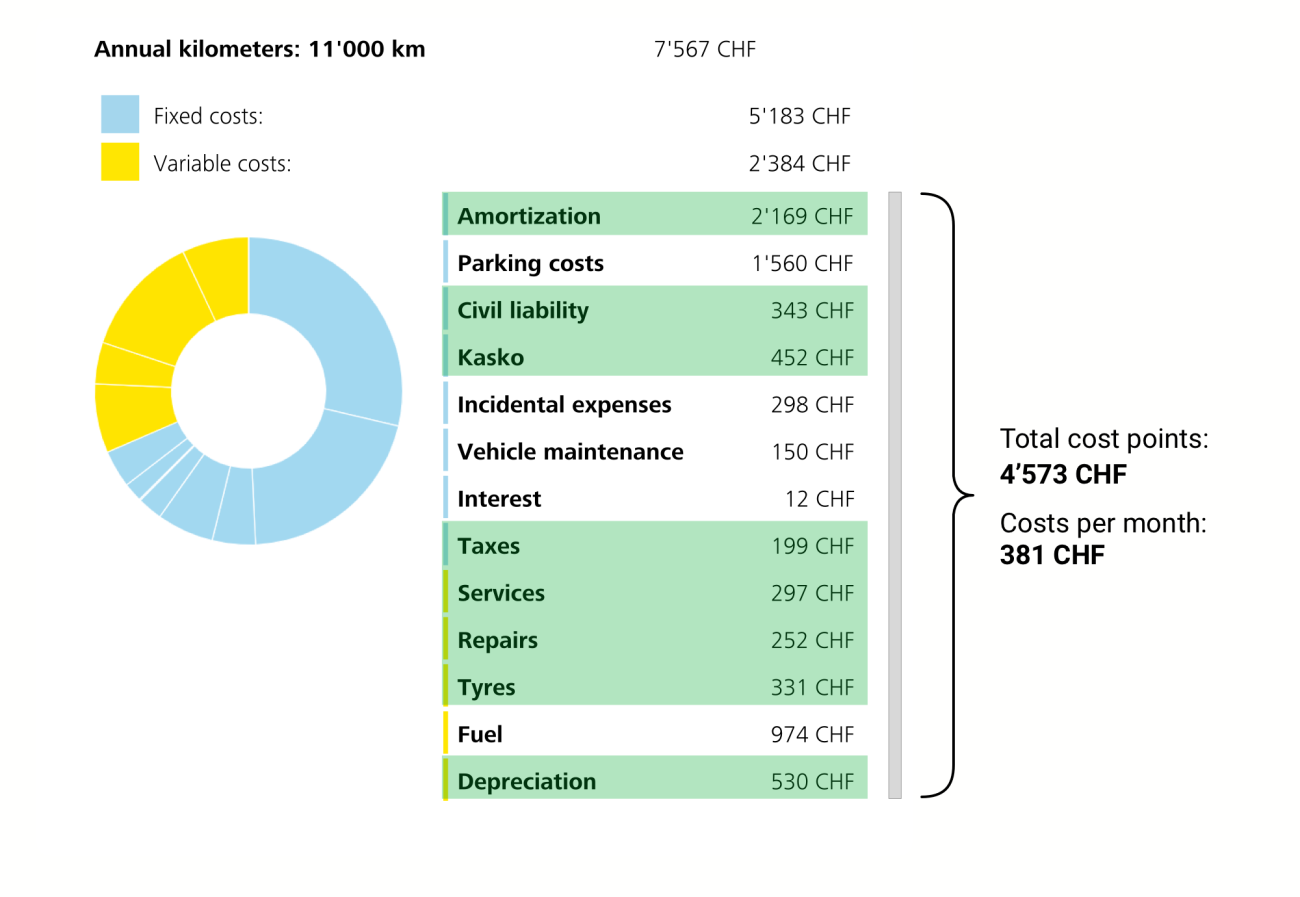

Thanks to the TCS, it is relatively easy to determine the operating costs of a car online. Click on the following link and simply search by make, model and special equipment. Based on a holding period of 8 years, the TCS calculates the operating costs, such as insurance, taxes, maintenance, service and tyres, depending on the annual mileage. It is important for you to know that the average holding period in Switzerland is shorter than 8 years and the costs can therefore be higher.

For a small car with the vehicle price of 24'100 CHF, the following costs result with the mileage of 11'000 kilometres per year:

- Insurance: 795 CHF per year

- Service and repairs: 549 CHF per year

- Tyre costs: 331 CHF per year

- Taxes (in the canton of Zurich): 199 CHF per year

That's additional running costs of 157 CHF per month.

If you buy your car, you can actually finish the calculation at this point. However, since many people lease their car or finance it in some other way, it is also worth taking a look at possible financing costs.

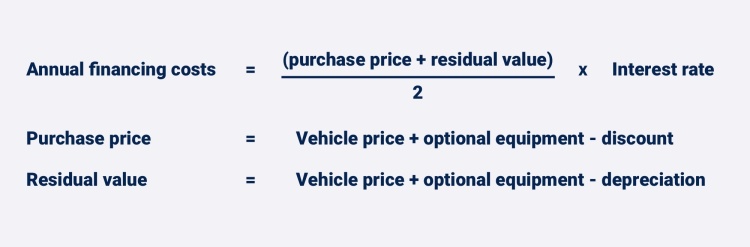

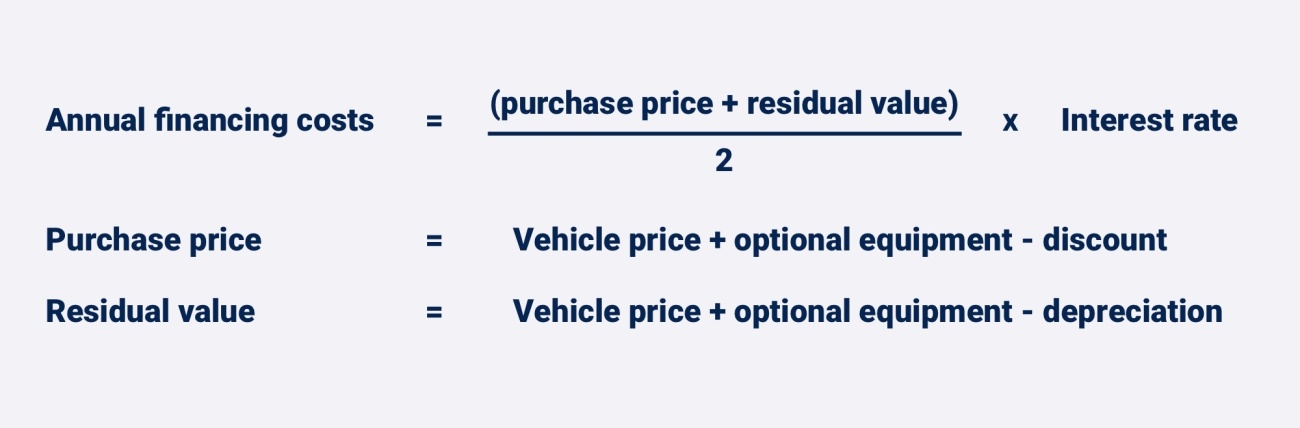

Financing costs

To simplify matters, it can be assumed that on average the difference between the value of the vehicle and its residual value has to be financed during the holding period. In other words, the value of the car (in the case of a small car, this means the price of the car and the optional extras together, i.e. CHF 27,948, minus the assumed discount, i.e. CHF 25,153) and the residual value after one year: CHF 20,961. On average, therefore, 23,031 CHF have to be financed. At an interest rate of 3.9%, this amounts to CHF 899 per year or CHF 75 per month. For three years, the monthly financing costs amount to CHF 64, per month.

If the individual items are cumulated, the calculation looks as follows:

Costs for a holding period of three years

- Depreciation or loss of value 311 CHF per month

- Operating costs 157 CHF per month

- Financing 64 CHF per month

Total CHF 532 per month

Costs for a holding period of one year

- Depreciation or loss in value 349 CHF per month

- Operating costs 157 CHF per month

- Financing 75 CHF per month

Total CHF 581 per month

If you keep your car for at least 8 years, the same monthly costs amount to around 380 CHF according to TCS.

If you keep your car for at least that long, you can derive the data relatively easily from the TCS data. However, the assumption of the 8 years duration is somewhat outdated today, as cars are changed more often in Switzerland. The monthly costs for a purchase would be CHF 381 per month but if the car is financed in some way, be it with a lease or a loan, the costs would be higher.

How would you like to drive the car?

The fact is that the costs go down with a longer holding period. However, with a longer duration, especially in times when cars and technology in electric cars is changing rapidly, the residual value risk increases. So before you buy a new car, you need to be clear about how long you actually want to drive your car. For a period of up to four years, a car on a Carvolution subscription is suitable, at least from a financial point of view. The fixed monthly price also means that you always have an overview of the total costs of the car in the car subscription. Because insurance, cantonal redemption, taxes, service and tyres are already included with Carvolution.

If the individual equipment of the vehicle is a central criteria for you, then buying or leasing makes more sense in some cases.

If you are interested and would like an individual calculation, please contact us at contact@carvolution.com or +41 62 531 25 25. We will then go through the costs of owning a car step by step.

Get the Supersavers

Discover new special offer models at unbeatable prices, such as the Toyota Yaris from CHF 239.– for 24 months. More top deals on Fiat, BMW, Opel & Peugeot models.